SMP Robotics Launches Leasing Program for USA Security Companies

SMP Robotics offers an alternative way to acquire and own security robots. Leasing of robots by US security companies has now become available. Leasing payments range around USD $1,500 per month, depending on the model of the robot.

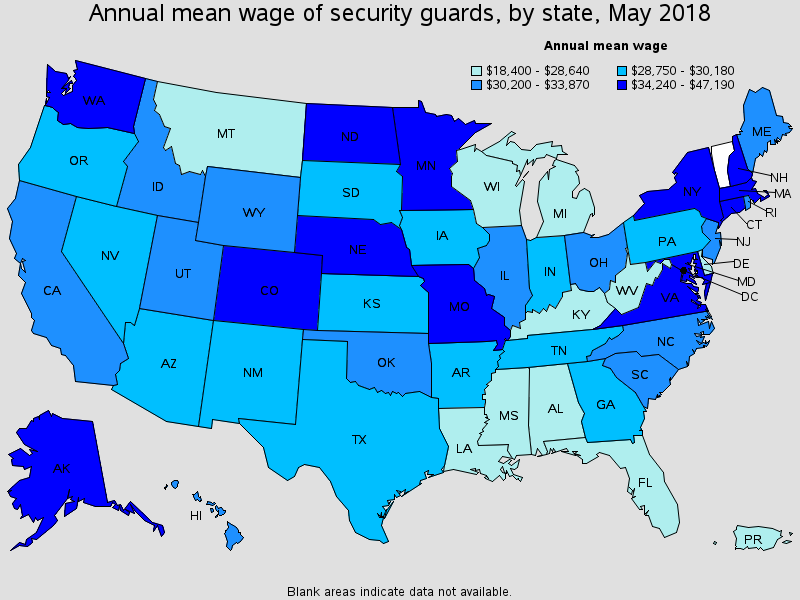

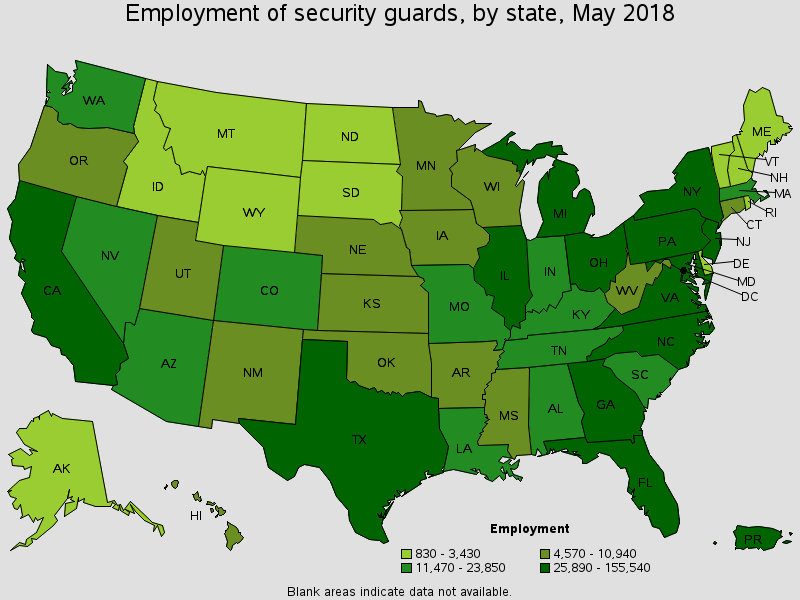

It is easy to calculate what additional profit the robot will bring with an average salary of security officer USD $30,000 per year or USD $2,500 USD per month. In addition, robots are able to patrol the protected area not for 8 hours a day, but much more, without sick leave and absenteeism.

Security business becomes high margin

Such a low rent allows you to turn a low margin security business into a high margin business. Moreover, the deferral of payments at the stage of implementation of robots allows you to enter the robotics business with minimal costs.

The highest profit from using robots is achieved when patrolling territories with a group of robots. It allows you to reduce the cost of their maintenance services on one hand and multiply the profit from the number of replaced security officers on another. When leasing security robots, especially a large number of them, the tax deduction for their payment is important.

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of robots and software purchased or financed during the tax year, up to $ 1,000,000 in year one.

You can get acquainted with the details on the page: leasing security robots in USA.

Source: bls.gov