Leasing Security Robots in the USA: Balancing CapEx and OpEx

A financing model tailored for CFOs and accountants

SMP Robotics offers a unique ownership model for autonomous security robots that allows businesses to keep capital expenditures (CapEx) and operating expenses (OpEx) in balance.

The scheme is simple:

- Hardware (robot body, sensors, mobility platform) — accounted as CapEx (capital investment, depreciated as equipment).

- Software and autopilot with AI updates — provided under a quarterly subscription, accounted as OpEx (operating expense, directly deductible).

This separation gives financial managers the flexibility to optimize cash flow, tax strategy, and balance sheet structure.

Why this matters for your business

- CapEx control – robots are booked as equipment assets, with predictable depreciation.

- OpEx flexibility – quarterly software subscription treated as an expense, supporting cash flow planning and immediate tax deduction.

- Lower entry threshold – initial investment is limited to hardware only; no need to capitalize the entire robot cost.

- Future-proofing – software is regularly updated (AI, navigation, analytics), keeping robots at the cutting edge without reinvestment in hardware.

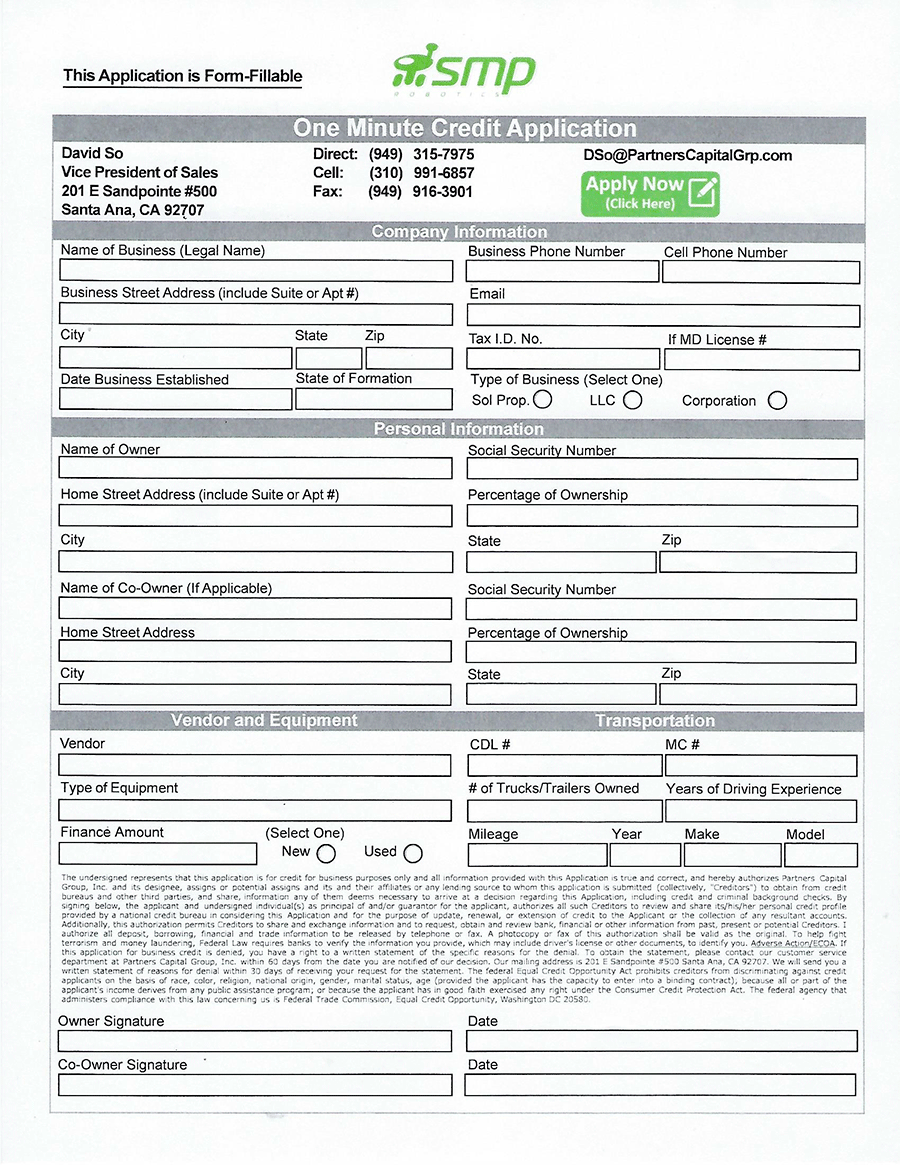

Financing Options in the USA

Through SMP Robotics’ cooperation with Partners Capital Group, businesses can access flexible financing programs:

- Leasing with deferred payments (up to 6 months).

- “Same as Cash” for 90 days.

- Application-only approval up to $500,000.

- Programs available for A, B, C, and D credits.

Tax advantages: Section 179

Under Section 179 of the IRS Code, businesses can deduct the full purchase price of qualifying equipment (up to $1,000,000 in year one).

That means the hardware portion of the robot may qualify for accelerated deduction, while the software subscription remains fully deductible as an operating expense.

More details: section179.org

Contact sheet – your leasing team

Once approved, we will send lease documents for you to authorize and then expedite your transaction.

Congratulations on your new robots! Not only do you get the return on your investment and grow your business, but you can also achieve any short to long-term business goals. That is what this is all about now is not it.

No payments until six months

Get approved with Partners Capital and you choose how many deferred payments you want, up to 3-6 months.

How to get started

- Start with 3 robots — the entry point for fleet operations.

- Finance the hardware through Partners Capital or your own leasing program.

- Subscribe to the software on a quarterly basis, keeping expenses in OpEx.

Our team provides:

- Remote support during the first deployment,

- Training for your staff,

- Continuous software updates.

With this model, accountants and CFOs can manage security technology as a balanced investment: robots as assets, software as services.

Learn more about ownership and financing options on our page: How to Become a Robot Owner.

Leases service from Partners Capital Group

- “Zero Percent” Financing

- 90 Days “Same as Cash”

- $500,000 App Only

- Up to 100% Prefunding

- Deferred Payments

- А, В, С, and D Credits

More about Partners Capital Group:

www.PartnersCapitalGrp.com

Phone: 866-417-8326

Fax: 949-916-3901

dso@partnerscapitalgrp.com